In today’s globalised world, an increasing number of people own real estate in more than one country at any one time.

As a result, there has been an increase in the number of people who have both an Australian Will and a Will in a foreign country to dispose of real estate owned by them. The intention (subject to the manner in which the Wills are drafted) is usually for the foreign Will to dispose of real estate in that foreign country and for the Australian Will to dispose of all other assets of that person.

However, if you first make an Australian Will that only deals with your assets in Australia, and later make a second foreign Will that states that it revokes all previous Wills and deals solely with your real estate in that other country, what is the status of your Australian Will? Has your Australian Will been revoked by the later foreign Will?

This interesting predicament has been considered by the Australian Courts, which have set out principles to reduce the uncertainty that this creates and have determined that the question of whether a later Will revokes an earlier Will ultimately depends on the intention of the Will-maker: did he or she intend to revoke the earlier Will?

In Australia, in so far as real estate is concerned, such issues are generally referred to the law of the place where that real estate is situated (the legal principle of ‘lex situs’).

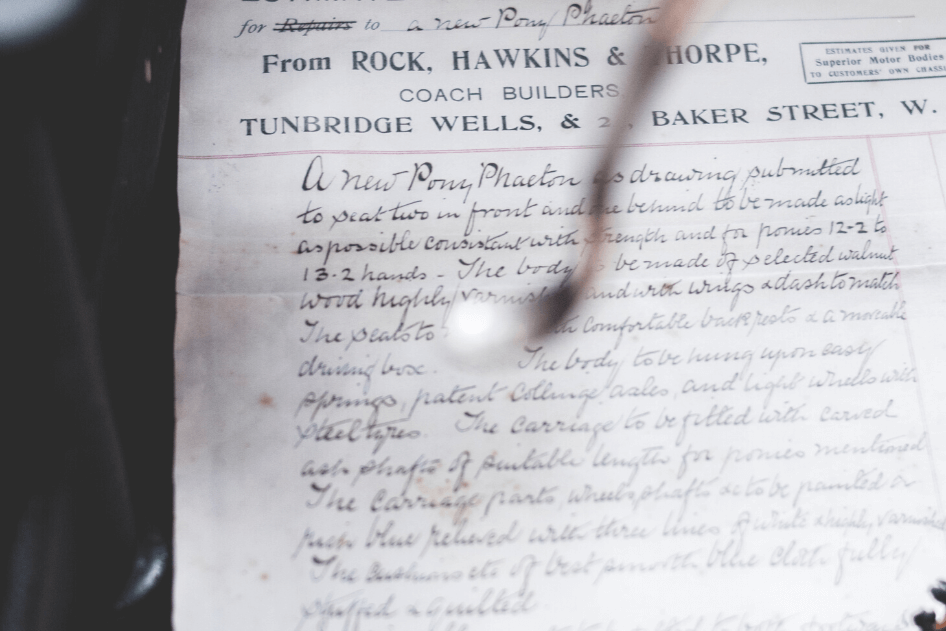

It has also been recognised since the 19th century that a general revocation clause in a Will (e.g., ‘I hereby revoke all Wills heretofore made by me and declare this to be my last Will’) is not sufficient of itself to revoke a prior Will if the Court is satisfied that the Will-maker did not intend by the later Will to revoke the earlier Will.

In determining the intention of the Will-maker, the Courts will look at a variety of factors, including:

- whether the Australian Will deals only with your Australian estate;

- whether the foreign Will deals only with your real estate in the foreign country;

- whether the later Will is sufficient by its terms to cause a revocation of the earlier Will (which is a question of interpretation of the foreign Will by the Courts);

- whether the foreign Will was ever intended to affect the Australian Will (which is to be determined as a matter of evidence according to Australian probate law);

- whether the foreign Will was made in the language of that country and not in English; and

- the terms of both Wills and the circumstances of their execution and signing.

The practical significance of this is that, if you own assets in Australia and also own foreign real estate, it is imperative that you obtain competent estate planning advice so as to avoid the risk that, at a later time, either your Australian or your foreign Will is deemed to have been revoked, when your intention and estate planning objectives may be clearly otherwise.

PLEASE CONTACT

Contact us at bbv@bbvlegal.com.au if you wish to discuss this matter or your estate planning objectives further.